One platform to power

all your payments —

so you can focus on growth.

Flintn lets you accept 150+ currencies and local payment methods with ease.

No need to open Acquiring bank accounts or have multiple Gateway agreements – we’ve got the global infrastructure ready.

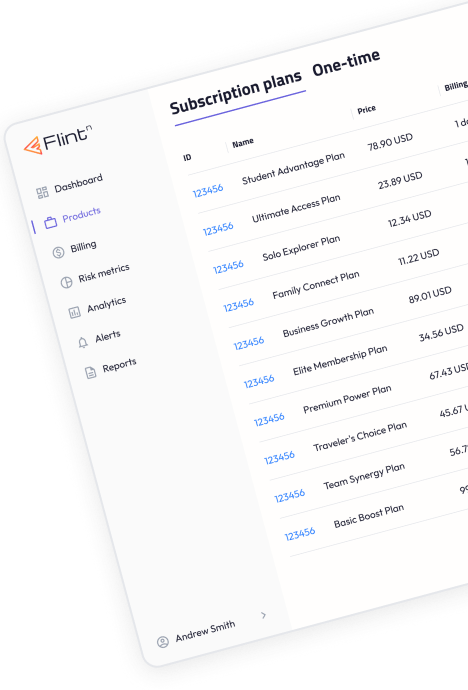

Running a subscription service? Flintn was built for you.

Automate recurring payments, prevent involuntary churn, and expand globally without payment headaches. Even as a startup, access enterprise-grade payment tech that scales with your subscriber base.

Why choose Flintn?

All-in-One Convenience

One integration for all payment needs.

Single Partner in Growth

Flintn acts as your business advocate, not just a provider your approval rates and revenue.

Superior Support

24/7 human support and guidance.

Secure & Compliant

Enterprise-grade security, compliance handled.

Smart routing with AI

Boosts your approval rates and revenue.

Compliance and fraud prevention are built in

Keeping your business safe 24/7.

Key Metrics & Milestones

Driving Business Transformation

30+

various business connected

21%

average revenue growth per business

3b+

success payments processed

80%

average acceptance rate